Due to its thriving market, superb infrastructure, and tax-free environment, Dubai has always been a magnet for real estate investors. The emirate has provided a number of investment possibilities for real estate aficionados throughout the years. Real Estate Investment Trusts (REITs) are among the most popular.

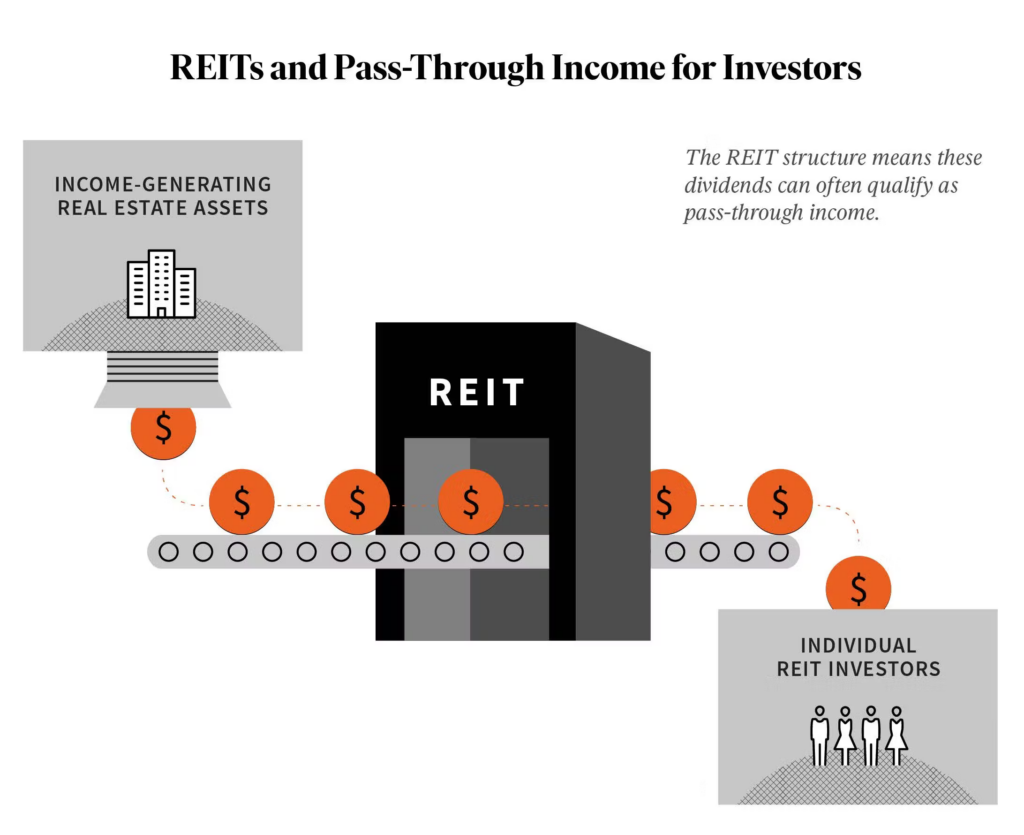

A real estate investment trust is a form of investment vehicle that owns and runs income-generating assets. It allows investors to invest in a wide portfolio of properties without purchasing them directly. Instead, investors purchase REIT shares and get a piece of the revenue generated by the properties as dividends.

The Dubai Financial Services Authority (DFSA) regulates REITs in Dubai. Emirates REIT and Dubai’s first Real Estate Investment Trusts, was established in 2010 and is traded on Nasdaq Dubai. Since then, numerous more REITs, including ENBD, Equitativa, and ENBD, have been established in the emirate.

High level of liquidity

The high degree of liquidity is one of the most significant benefits of investing in REITs. Unlike real estate, Trusts may be readily purchased and sold on the stock exchange. This makes it a more adaptable investment option, particularly for individuals seeking short-term returns.

Furthermore, investment in REITs provides investors with access to a diverse portfolio of assets in various sectors such as residential, commercial, and retail. This not only distributes the risk, but also gives exposure to diverse revenue sources, providing investors with a secure and predictable income.

Professional property managers

Another advantage of investing in Real Estate Investment Trusts is that it allows investors to participate in market growth without having to manage the properties themselves. The REITs are managed by experienced property managers who have the skills to discover and maintain the properties, ensuring investors get a consistent source of income.

Furthermore, REITs in Dubai are tax-exempt, so investors may enjoy the whole income generated by their assets without any deductions. As a result, Real Estate Investment Trusts are a very appealing investment choice, particularly for high-net-worth individuals and institutional investors.

Investments risks

However, REITs, like any other investment, carry certain risk. The real estate market’s change is the most important risk. Because the value of the properties can fluctuate, so can the value of the shares. Furthermore, payouts are susceptible to market circumstances and may fluctuate over time.

Finally, REITs have grown in popularity among investors seeking to diversify their portfolios and acquire exposure to the Dubai real estate market. REITs provide investors with liquidity, diversity, expert management, and tax advantages. However, before investing in REITs, investors should perform careful research and seek expert counsel, just as they would with any other investment.